Most of the government mortgage brokers (USDA, FHA, VA) have relevant financing costs. Even though this initial fee is going to be named multiple names between mortgage apps, he could be basically the same task. FHA relates to the commission just like the initial home loan insurance coverage (UFMIP) Virtual assistant means this since an effective financial support payment USDA Outlying Property phone calls so it payment a good Be certain that Payment

All USDA fund (get and you can refinance) want a-one-big date Guarantee Percentage which is put into the fresh borrower’s loan. The modern level of this new USDA ensure payment is actually step 1%. Example in the event that a borrower was to shop for a property 100% investment having $150,000, this new modified loan amount to the 1% USDA make sure payment will be $151,500. $step 1,five hundred is actually set in the base amount borrowed.

In addition to this that-time Be certain that Commission, USDA fund require also a yearly commission that’s placed into this new monthly mortgage payment. Fundamentally, the new yearly fee is monthly mortgage insurance rates or higher often called PMI Once more, such as the more than, it does have many more names. The present day number of that it percentage was .5%.

Example in the event that a borrower try to invest in property 100% financial support having $150,000. $150,000 x .0035= $. $525 ‘s the annual matter, today split that it by the one year = $ is the amount of month-to-month mortgage insurance rates which is additional on borrower’s USDA loan.

Recall these types of fees are not the only loan-relevant costs otherwise closing costs which have USDA loans. USDA mortgages (like other fund) will also have every conventional settlement costs that include a fl mortgage. Assessment, Survey, Identity, Authorities taxation, lender fees, together with all the homeowners insurance and you will taxation reserves getting your own escrow account. On the whole, it is preferable to find regarding the cuatro% of your own cost is required for all closing costs and prepaid service reserves. Which profile is move a few per cent, regardless, with regards to the loan amount. Large USDA loan number would be a lot less regarding a portion due to the fact a number of the USDA closing costs ( assessment, questionnaire, etc) try fixed will set you back and don’t changes according to the family client’s purchase price/amount borrowed.

Guaranteed Outlying Homes Financing have been around for a while, and also have helped of many group and people purchase belongings within the rural section.

Guaranteed loans can be produced into the sometimes this new or established belongings which can be structurally voice as well as in a great resolve. There aren’t any limits for the size otherwise design of your house funded, nevertheless can not be familiar with make money. The newest loans can be used to buy otherwise re-finance a residence.

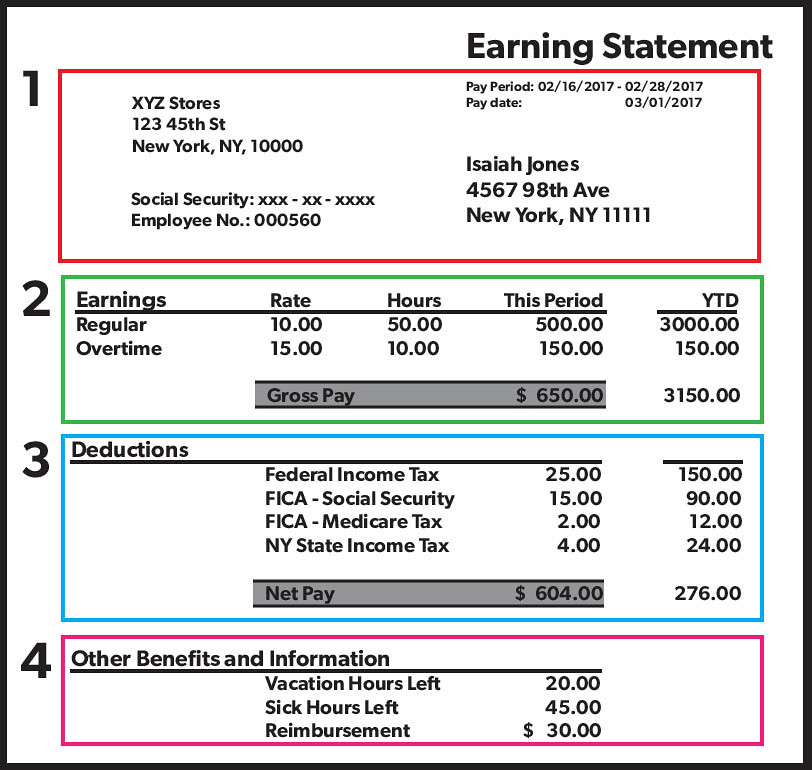

Less than we have detailed the current USDA home loan charge to have 2018

When your appraised well worth is higher than the sales speed, you can easily finance closing costs and you will prepaid expenditures within the towards amount borrowed. Providers are permitted to spend the brand new consumer’s settlement costs also.

The newest people have to inhabit the home because their top house. online installment loans Ohio Its income ought not to exceed this new moderate money limits established from the the latest county.

There clearly was an automated money qualifications calculator into the USDA Net webpages here gives information about qualified property cities due to the fact well.

So you’re able to qualify for this option, consumers need a credit history and you will verifiable money. They must be You.S. owners otherwise long lasting resident aliens. Guaranteed rural construction financing wanted your family percentage, and prominent, notice, taxes, and insurance policies, must not exceed 30 per cent of borrower’s revenues. The entire bills, like the new house payment separated by borrower’s gross income, ought not to surpass 41 %.

Other variables to conquer large ratios will be the conclusion out of homebuyer knowledge categories otherwise future income off a partner or other co-debtor just who generally worked which will be trying a position.

The application doesn’t need one to borrowers become earliest-big date home buyers, however they might not individual a property in this travelling length of your house are bought. Consumers should be incapable of see home financing not as much as almost every other software demanding a deposit. The new funds together with could be designed to refinance either current USDA Rural Creativity Guaranteed Houses otherwise their Area 502 Head construction financing.

Particular exceptions to the qualifying rates tends to be made to individuals with high fico scores, a history of discounts or equivalent most recent construction bills

The fresh new home becoming financed by this system should have access out of a street, roadway or driveway, and all sorts of roads and you may ways must be in public managed into an effective hard surface. New property can’t be subdivided.