LAR Application for the loan Register (also known as the new HMDA-LAR, brand new LAR, or the Register) The term LAR refers to the application for the loan check in style you to definitely has been prescribed having reporting HMDA dataputer-made accounts need adhere to the brand new structure of your LAR

Gross Yearly Income The income claimed is the full terrible annual money an institution relied abreast of for making the financing choice.

HOEPA, passed within the Details in the Financing Operate, imposes substantive constraints and extra disclosures to the certain types of household mortgage loans which have cost otherwise charges a lot more than a specific commission or count

“NA” is used step 1) when an establishment does not request the newest applicant’s earnings or have confidence in it in the credit ily hold, 3) brand new candidate isnt a natural person (a business, firm otherwise relationship, such as for instance), or 4) brand new applicant info is not available since loan try purchased by the facilities. “NA” is even used in financing to an institution’s teams to safeguard the privacy.

HOEPA Home ownership and you may Guarantee Coverage Operate Lenders are required to declaration if financing is susceptible to the provisions of the HOEPA. To learn more on the HOEPA, understand the CFPB’s Controls Z, parts 1026. There’s also more questions relating to HOEPA from the HMDA Speed Study Faqs (FAQs) section of the pursuing the hook up:

Do-it-yourself Mortgage Property update financing is actually (a) people hold-secure loan for use, at least to some extent, for fixing, rehabilitating, restorations, or improving a home or even the real-estate on which this new hold is positioned, and you can (b) people non-dwelling-secured mortgage (i) which will be utilized, at the very least to some extent, for example or maybe more of those intentions and you can (ii) that’s classified since the a home update financing by establishment.

Domestic Get Mortgage A house get financing is actually people mortgage covered of the and made for the true purpose of to get a dwelling. Comprehend the concept of “hold.”

Application for the loan Number A different identifier (around twenty five characters much time) which you can use in order to retrieve the loan application so you’re able to which the admission applies. It is recommended that organizations do not use applicants’ names otherwise public defense wide variety to ensure the confidentiality of candidate or debtor.

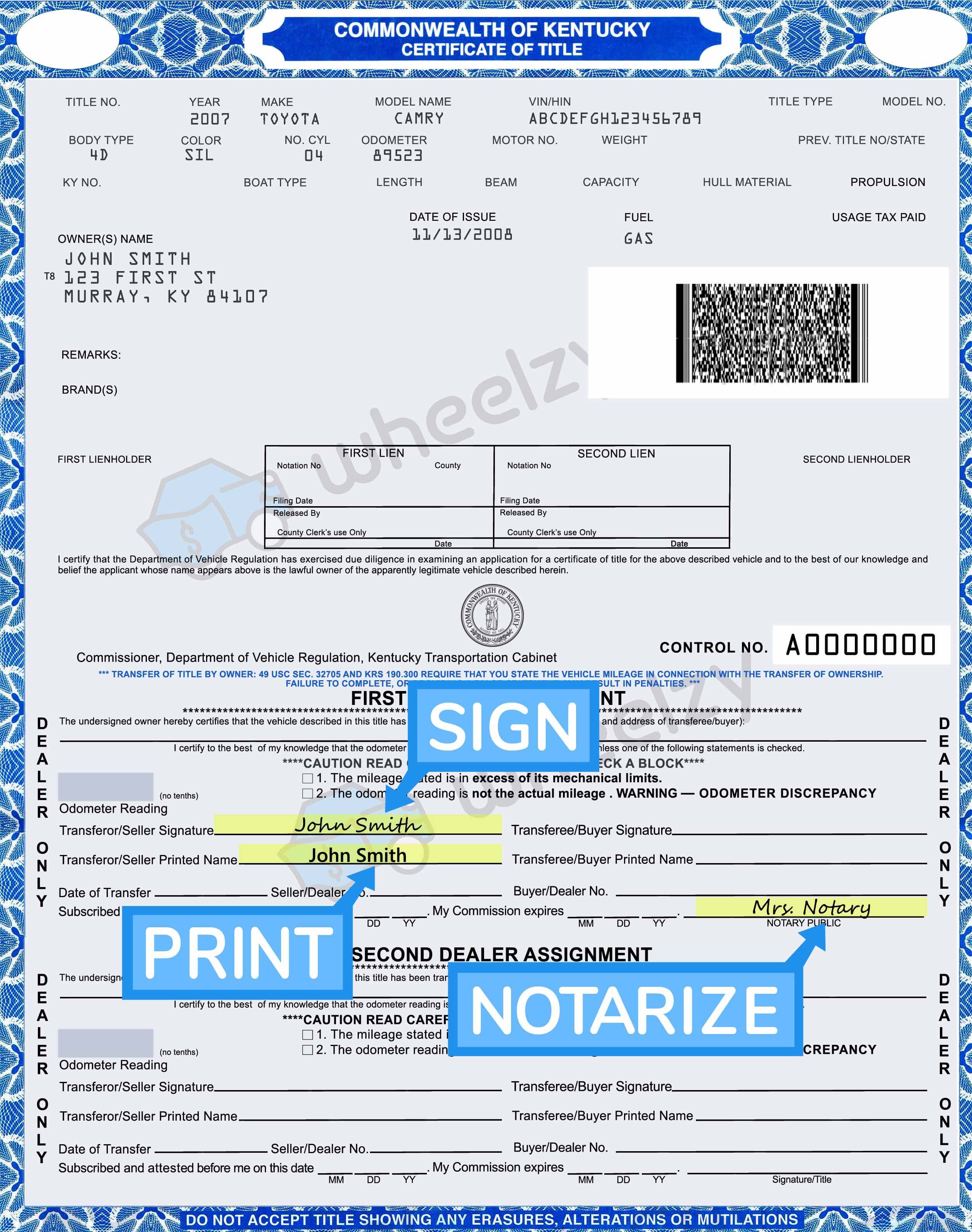

Lien Standing To possess HMDA reporting purposes, lenders are required to statement lien position having finance it originate and you will apps that do not trigger originations (Codes step 1 through step 3 are used for these types of loans; Code cuatro is used for bought finance). Lien reputation depends upon reference to the better pointers readily open to the lender during the time finally step are removed and the lender’s very own steps. Lien condition helps with the fresh interpretation regarding price investigation. To learn more about lien position, understand the HMDA Speed Analysis Frequently asked questions (FAQs) section of the adopting the link:

Loan Goal Implies if the purpose of the borrowed funds or software installment loans online San Francisco California try to possess household get, do-it-yourself, or refinancing. If for example the financing falls to your multiple of your own around three classes, report the borrowed funds under an individual classification according to following signal. If for example the financing is a home get financing, declaration it eg no matter if it is quite a property upgrade mortgage and you may/otherwise refinancing; if for example the financing isnt property buy financing but is a home update mortgage and an effective refinancing, statement it as a property upgrade loan.

MD – Urban Division An urban division try good subset out-of an enthusiastic MSA having one center that have a society of dos.5 million or higher. Having revealing and you may disclosure purposes of HMDA, a keen MD is the relevant topography, not the new MSA of which it is a department.