Obligations profile were on the rise recently, with complete home obligations in the You.S. hiking to $17.5 trillion towards the end out of 2023, depending on the Government Reserve Financial of new York. And, using debt of has gotten more difficult for almost all, due to the ramifications of inflation and you can the present high interest levels was making both loans while the cost-of-living so much more expensive.

Whenever debt stacks right up beyond the point of manage, some people turn-to bankruptcy while the a remedy. Actually, there have been almost five hundred,000 non-team case of bankruptcy filings from inside the 2023, upwards 16% on season early in the day, predicated on data in the Administrative Work environment of one’s U.S. Courts.

However, bankruptcies do not always rub this new record totally clean, and also the short-title outcomes on your borrowing from the bank normally loom high. Yet with enough persistence, you can purchase back on the right track financially – also concise of being capable accept generous obligations once more, such as for example home financing . But how just does that really work?

Would you nevertheless get home financing immediately after personal bankruptcy?

You may not be eligible for home financing right away immediately after going right through bankruptcy, but that is essentially something that you normally generate support so you can.

“If you are a personal bankruptcy try your own economic problem, this is not a great disqualifier for getting home financing,” claims Christy Bunce, president within The latest Western Money.

“When they registered to possess a part seven liquidation, and that removes costs in return for allowing liquidation of any unprotected assets, it will generally need 2-3 years to possess an effective borrower’s borrowing to recoup good enough in order to qualify for a timeless home loan. When they filed for and you can accomplished a chapter 13 reorganization, where the borrower repays as often of their obligations as they have enough money for more an excellent three- to help you four-seasons several months, after that the credit can get well within 1 year,” shows you George Vogl, controlling movie director at Stretto.

“Loan providers and you may financing buyers put the absolute minimum time – also known as seasoning – anywhere between if case of bankruptcy takes place just in case a guy manage qualify for a home loan,” states Bunce.

Usually, Federal national mortgage association and you may Freddie Mac computer fund need a several-season wishing several months, if you are Federal Construction Management (FHA) funds has a two-12 months wishing period just after a part eight bankruptcy, she adds.

Chapter 13 bankruptcies, however, don’t have the exact same criteria, Bunce claims, “so long as you keeps a single-year commission record no late repayments and acceptance from the legal.”

Why does a bankruptcy proceeding apply at mortgage qualification?

you might qualify for home financing once a given waiting period, the borrowed funds certification criteria may differ following the a bankruptcy, according to the lender.

“Lenders might need a high down payment in order to decrease the exposure, often anywhere between 10% in order to 20% or even more,” says Michael jordan Leaman, branch functions manager in the Churchill Financial.

As well as potentially purchasing a whole lot more upfront, your own costs will also be higher as loan providers may charge higher mortgage rates of interest “than others offered to individuals which have brush borrowing histories,” Leaman contributes.

That said, cannot think that you have to capture any financial prices come your way. Whenever you are your options might possibly be a tiny slimmer and a lot more high priced just after dealing with case of bankruptcy, you can however usually see some lenders who are prepared to work with you and gives an even more sensible rate of interest range.

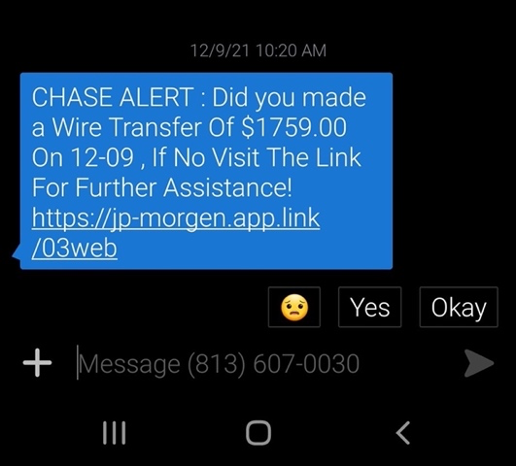

“New debtor can get a high than sector interest rate but are going to be cautious with one financial asking for substantially greater payday loans Weatogue than industry costs,” says Vogl. “Likewise, there are certain credit resolve and you can borrowing from the bank reconstruct company who’ll get the fresh new has just released debtors having unlikely promises and you may unrealistic fees to possess functions.”

How exactly to replace your probability of being qualified getting a home loan after case of bankruptcy

When you’re personal bankruptcy renders getting a home loan much harder, borrowers could take the appropriate steps which make all of them ideal home loan candidates immediately following case of bankruptcy.

For one, “the borrower definitely must address people expense that endure the fresh new bankruptcy proceeding and get in the a good standing on their repayments. This is the most important factor one potential lenders will see,” claims Vogl.

You can use the many years it could take becoming eligible for a mortgage to alter your financial situation.

“Within the waiting months, you will need to work on reconstructing the credit, together with controlling your bank account sensibly, purchasing your own costs on time, and preserving your borrowing from the bank balances low. Demonstrating voice economic conclusion might help alter your chances of being accepted to possess home financing,” states Bunce.

The newest prepared period may also have some upsides, such as providing more hours to cultivate their down fee, which will help beat home loan pricing that you’d otherwise deal with.

“Saving for a much bigger advance payment may improve your application, since it reduces the lender’s risk. Concurrently, interesting a large financial company whom specializes in working with people with prior borrowing from the bank situations also have beneficial pointers,” says Leaman.

The conclusion

Though personal bankruptcy tends to make taking a mortgage more complicated, you could potentially have a tendency to meet the requirements once more after a while. During those times, you can take the appropriate steps eg boosting your credit rating by the consistently paying costs punctually whilst rescuing for more substantial off payment. Which can help you qualify for a far greater home loan rates and slow down the total count you borrowed too.