Borrowing standards to possess financing so you can people tightened up from inside the net terminology into the all of your biggest euro urban area countries in the 2nd quarter out of 2023 (see Assessment desk). Credit requirements to own houses funds and borrowing conditions having credit rating or other lending so you’re able to domiciles tightened up in the Germany, France and you https://paydayloancolorado.net/rifle/ will Spain because they remained intact from inside the Italy.

The latest decline are again significantly more powerful than questioned by finance companies inside the the earlier quarter. All round amount of rates of interest and you will repaired funding remained this new chief driver out of smaller loan demand, highlighting the latest dampening perception off rising interest rates into the mortgage consult and you can monetary progress. Mergers and you will buy (M&A) interest (used in almost every other resource needs) and readily available interior money (used in usage of alternative financing), highlighting business earnings, together with dampened mortgage request. The new decrease in financing consult is actually very strong into the historic position for both enough time-label and you may quick-label finance. On the 3rd quarter out of 2023, banking institutions predict a much deeper internet reduced total of demand for money in order to companies, but far smaller compared to regarding the second quarter (internet percentage of -6%).

Firms’ net interest in money (web portion of -42%, once -38% in the earlier quarter; pick Overview desk), shedding to a the majority of-go out lower because start of questionnaire from inside the 2003

The net reduced total of demand for houses finance remained good in the next quarter away from 2023 however, is actually lower than new sharp web decrease in the previous a couple quarters (websites part of -47%, just after -72% and you can -74% in the 1st one-fourth out of 2023 and also in the fresh fourth quarter out-of 2022 respectively; discover Assessment desk). The new reduced amount of next quarter are apparently close to the really worth asked by banking institutions in the previous quarter. Large rates, decline housing industry candidates and lowest consumer rely on the contributed negatively on the interest in loans getting home pick. The web based e less (web percentage of -12%, just after -19%, select Evaluation desk), generally in accordance with just what banks got asked in the earlier one-fourth. Here, to help you an inferior the quantity than in the original one-fourth of 2023, low individual rely on and you will spending on strong items triggered straight down demand, while high interest rates got a similarly higher dampening affect interest in credit such as the last quarter. In the 3rd one-fourth off 2023, financial institutions expect a deeper, in the event markedly shorter noticable, internet reduced total of homes mortgage consult (net part of -18%), and you may a deeper net reduction of demand for credit, albeit somewhat smaller (-8%) than in the next quarter.

Finance companies stated a hefty online reduced total of need for fund in order to organizations across all four biggest euro urban area nations on second quarter from 2023. Internet demand for construction fund went on to reduce significantly throughout five largest euro city nations. Interest in credit diminished inside the web terminology in every five premier euro area nations so you can a comparable knowledge.

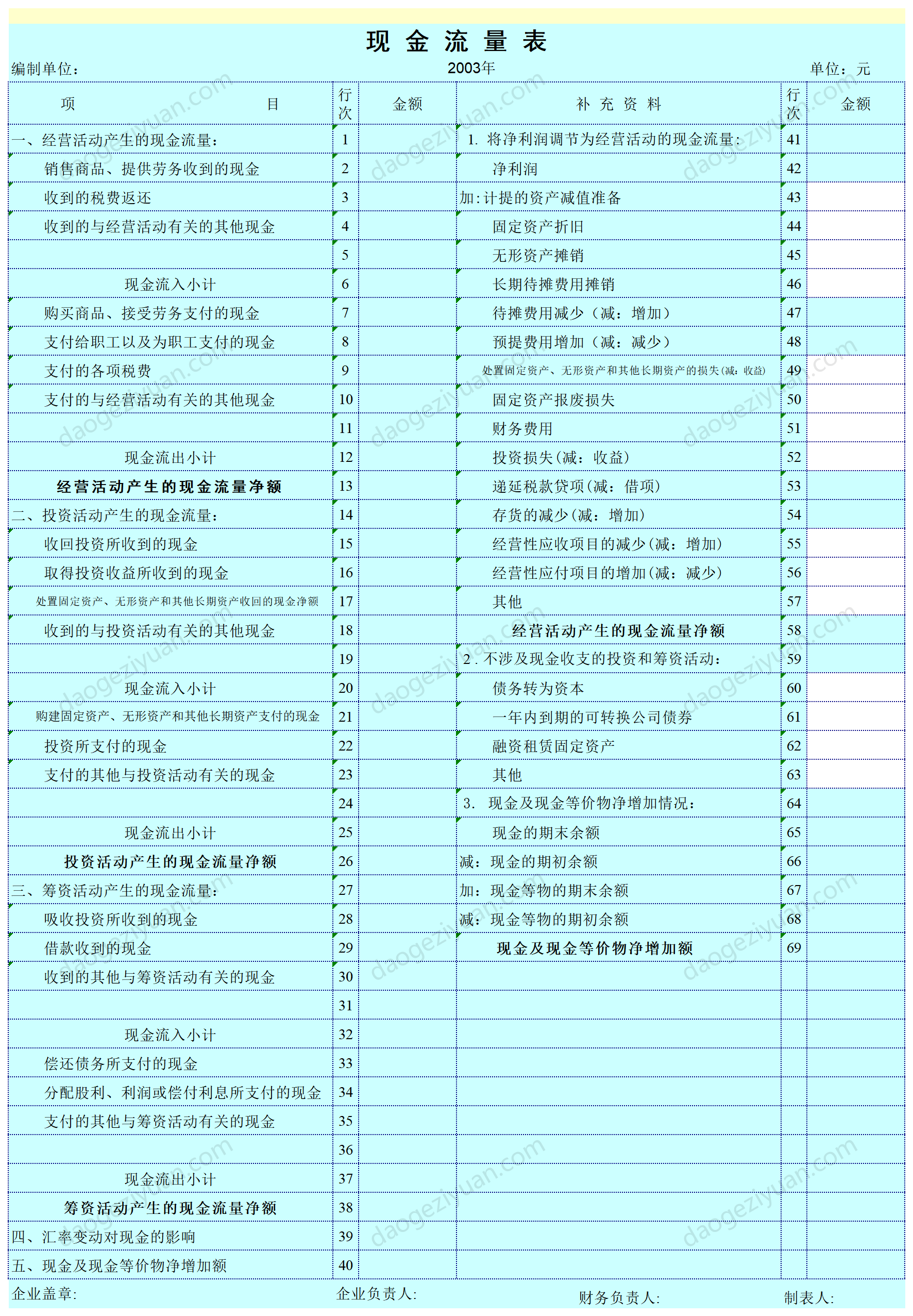

Assessment dining table

Notes: Avg. identifies historical averages, which can be calculated across the period since the beginning of your questionnaire, leaving out the most recent bullet. Because of the many shot models across countries, and that generally echo the difference regarding federal offers into the lending with the euro urban area low-economic individual field, the size and style and you may volatility of your online percentages cannot be really opposed all over regions.

Euro area banking institutions reported that the access to financial support deteriorated in the really , especially in merchandising financial support. The fresh advertised web damage for the entry to shopping investment can get echo increased battle having shopping dumps in the present ecosystem off growing remuneration of dumps and you may outflows regarding right away deposits. That is affirmed by the obvious deterioration during the access to short-identity retail resource (14% in internet conditions, the highest just like the first one-fourth from 2012). For loans securities, the fresh break down reflects somewhat highest financial bond production compared to brand new end of your own very first one-fourth, when you find yourself the means to access currency areas remained generally intact. From the third one-fourth from 2023, access to merchandising capital and to most of the sourced elements of general funding is expected to help you deteriorate a little.