Since the pay because of the mobile phone bill means one to features a phone amount, you should choose from the new mobile fee team readily available in your area. See a favourite system seller on your own country and acquire your own mobile count to get started. The majority of them possess some greeting also offers available to possess the fresh punters.

Book of Gold Double Chance real money | Using an excellent smartwatch having Yahoo Spend

- Fruit rolls out regular software reputation in order to iPhones, making certain gizmos are nevertheless secure or more yet on the most recent features.

- Check out the full terms and conditions on the internet prior to signing upwards.

- Carrying out money experience you to combine repayments invention, quicker rubbing, and cost savings is at the newest core out of everything we do.

- You may either pay entirely monthly or pay more than day having minimum payments.

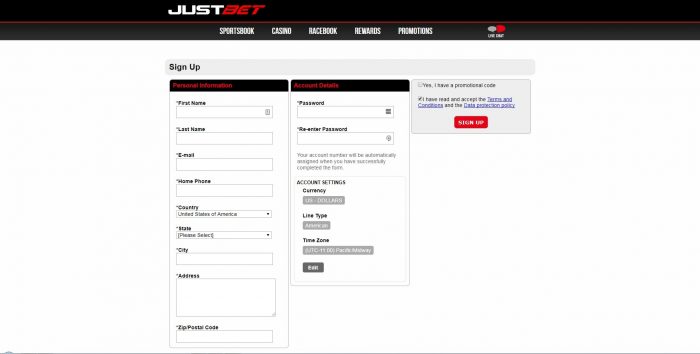

- If you’re looking to become listed on an online casino, constantly allow it to be properly registered and never subscribe a casino that’s not registered to perform inside country.

- While the 2019, all Chase Visa notes were equipped to have contactless money.

- Payment notes aren’t the only real things these types of purses can also be exchange to you.

Planning on getting the new software and changing their commission steps over to Yahoo Spend? Here’s the action-by-action self-help guide to starting and making use of they in shops. If you pay late, you can even incur expensive late charge, plus credit score might possibly be affected.

Do i need to get bonuses having cellular deposits?

Since the fee info is stored to the cellular phone and you will transmitted wirelessly to your commission critical through NFC technology, there’s quicker worry about anyone taking a physical card otherwise cash. Of a lot know the sense of position from Book of Gold Double Chance real money the a good checkout range, fumbling because of a pouch to find the right charge card otherwise depending up the bucks you’ll need for a buy. In the today’s digital-very first community, contactless mobile phone repayments have transformed how somebody shop. An electronic digital handbag locations your fee guidance and you can enables you to pay with your phone in places.

Should you Pay The Debts Having credit cards?

The brand new cards also provides perks including no overseas purchase charges, roadside dispatch, car local rental collision ruin waiver, and a lot more. The brand new Delta Rare metal card is yet another Western Display mastercard one now offers wonderful features (especially having Delta Sky Traces) complete. Other awesome benefits were warranty, get shelter, without foreign purchase charge (rates & fees). It credit now offers a $300 annual travelling borrowing from the bank to have bookings generated for the Financing You to Traveling site. Your even awaken in order to $a hundred borrowing to own Worldwide Admission or TSA PreCheck! Moreover it includes a good wedding added bonus away from 10,000 Financing You to miles.

First, you’ll need down load the new Bing Spend app (earlier Google Purse) for many who don’t already have it on the Android unit. To utilize tap to spend on the Pixel Bend or other folding unit, fold your equipment. You need to use their cellular phone to pay for goods otherwise functions having Yahoo Handbag.

Actual percentage is dependent upon payment card processing record, amount borrowed or any other qualifications things. At least percentage becomes necessary and you need to repay your loan since the given from the loan terms. Take on contactless cards and you will electronic purses individually with Tap to help you Shell out for the new iphone 4 or Tap to spend to the Android. You may also connect your existing online store or software so you can one of the safe and trusted payment APIs. Take contactless payments with just the Android os cellular telephone — no methods needed.

In reality, 507 million new iphone pages had Fruit Shell out by 2020, based on Statista. Many fee software give encrypted money and you will wear’t shop their percentage advice individually, it’s vital that you see an app one to publishes defense details in public. It will help ensure your bank account and you will playing cards is actually kept properly. In addition to, only use software offering pin amounts otherwise biometric accessibility controls, then securing your money for individuals who eventually eliminate your own cellular phone. Contactless percentage actions was becoming more popular among both resellers and you can users, specifically in the course of the brand new pandemic.

Various other fellow-to-peer commission app that numerous people have fun with are Bucks App. Once downloading the brand new software and you may doing a merchant account, you can post currency quickly for other Cash Software profiles. With well over 90 million account, Venmo is usually considered the most used fellow-to-fellow fee system. It’s not surprising because it simply requires several taps in order to post money from your money to another Venmo representative. The first time you utilize Yahoo Handbag, you’ll be required to install an excellent PIN to possess transactions, and therefore i encourage you utilize each time you post money.

Past standard banking shelter techniques to own on line expenses pay, there are even individual behavior you may make to ensure your information is secure. Such, you need to use a powerful password and two-basis verification in which readily available. You will need to make sure that there are sufficient money on your checking account to cover money. If you will find shortage of financing, the financial can use overdraft defense to cover the fee, and you may sustain costs.

Apple Pay is one of the most well-known electronic payment characteristics global, allowing profiles to shop for content on the apple’s ios programs, the internet and in real world. It can be used to invest with your iphone 3gs, Fruit Watch, apple ipad and Mac computer, and it’s really approved because of the many up on thousands of retailers. The fresh chill most important factor of Apple Pay would be the fact it really digitizes debit/credit card chips, giving somebody the option of contactless payments. What you need to create is positioned the mobile phone otherwise view as much as the fresh terminal. Playing with Charge otherwise Charge card borrowing and you may debit cards is actually a well-known opportinity for placing finance inside the web based casinos. This process is just as simple as to make an on-line transaction.

Make use of line of credit to make purchases in only a great couple ticks. In the event the approved, PayPal Credit would be quickly placed into their PayPal Bag. For example, having fun with BNPL can help you purchase your boy an alternative computer within the busy back-to-university seasons. It can also help connection the new monetary pit to possess unforeseen expenses, such replacement a reduced smartphone or security system. For those who’lso are for the a fixed monthly budget, it assists your stay inside your mode, also.

The new Pursue examining consumers take pleasure in an excellent $300 incentive once you unlock a great Chase Complete Checking membership making lead dumps totaling $five-hundred or maybe more inside 3 months away from coupon registration. In the Local casino Crawlers, there are numerous 100 percent free casino games, harbors, web based poker, roulette, black-jack, baccarat, keno, bingo, craps, and many more dining table and you can cards to gamble online. Employing this webpages, your agree to our terms of use and you can privacy. For individuals who pay your declaration balance every month (your full costs over the past billing period), you’ll end paying interest. The best way to pay punctually is with autopay to make at the very least minimal monthly payment.

- It’s you’ll be able to almost every other banks will offer this method by the point the brand new SCA goes into force, however, right now simply TSB allows customers to get their OTPs via a good landline.

- The newest Chase Sapphire Set aside cardholders can also be discover 60,100 added bonus issues once paying $cuatro,one hundred thousand in the orders in the 1st 3 months away from membership beginning.

- As an alternative, you to definitely guidance life on the internet’s shielded servers which is highly encoded.

- A few of the finest rewards credit cards have EMV processor technical.

- You will require an alternative account so you can withdraw their money in order to such as Skrill or Charge including.

Sure, you can register the newest cards by the beginning Samsung Shell out and scraping the newest Menu icon regarding the finest proper part. Yes, in-app orders made out of Samsung Pay are only because the secure as the in-shop sales made out of Samsung Pay. In reality, in-software as well as in-shop orders made with Samsung Pay become more secure than simply swiping a normal credit card from the part away from sale. Canceling a cost made with Samsung Spend is equivalent to canceling an installment generated to your a physical credit. The actual processes depends on the brand new principles of your card issuer plus the supplier you have made the purchase out of. Samsung Pay demands an energetic web connection when incorporating an installment credit.

Learn about ways to save money on a strict budget, and getting support and negotiating having providers. Fiverr, Upwork or other money-and make applications link freelancers in order to subscribers looking labor. Thus, for individuals who’lso are skilled in writing, sales, construction, website development or another town, you are able to get taken care of gigs. Never share their Public Protection amount, savings account count otherwise driver’s licenses count. For additional info on the huge benefits and you can drawbacks ones programs, understand recommendations from the ios Software Shop and you may Google Enjoy, and on SurveyPolice.com.

When you get money, extremely apps shop your money inside the a hanging put, a sort of limited checking account. Zelle and you will Yahoo Shell out will be the conditions here, taking money directly to the new recipient’s family savings. Many of the apps, including Venmo, wanted a charge to remove money from the software account for the your finances (find next area). Get started by the addition of their borrowing from the bank and you will debit cards for the Huawei mobile. People store which will take one of many before described steps — PayPal cards, PayPal NFC money, otherwise PayPal QR codes — can be accept PayPal. When it comes to PayPal cards, it indicates people store which takes Bank card.

NetBet supporting Boku places, and therefore you might put today and you can shell out later your own cellular bill, otherwise make use of pay-as-you-go balance. Discover their own characteristics and contrast the fresh reviews to see which one suits you better. To ensure that our clients don’t get into which pitfall, i’ve excluded all casinos which use Boku because the asking provider. Those people casinos included in the list over is actually Pay because of the Cell phone Just gambling enterprises, to help you be confident that you are only billed to have the fresh money your demand. Like many digital financial characteristics including Visa otherwise Paypal, it is the supplier otherwise bookie you to definitely covers the little transaction percentage on the convenience of the service.

After you spend from the cellular phone, your usually discover the digital handbag and select and this method to use—exactly as you’d a classic handbag. Such Venmo and you can PayPal, you need to use a charge card since your commission strategy. But not, a great step 3% percentage is applicable along with your mastercard seller can get password the newest transaction since the a cash loan. Having Apple Pay, you can just utilize the bank card you’ve got for the document with your iTunes membership you can also make use of the Purse application for taking a photo of every Visa, Mastercard otherwise American Show card you own.

Fee Shelter is an elective get which can security your minimum monthly premiums otherwise entire PayPal Borrowing equilibrium around $ten,000 just after specific qualifying existence incidents. Whether or not you buy Payment Protection will not connect with their credit terms of one existing charge card arrangement you have got that have you. Using your own debts which have a credit card tends to make your daily life smoother which help your build credit for those who repay your balance every month. And, when you use a perks bank card, you can generate perks reduced than you might otherwise.

And once you start to invest with your mobile phone as well, you’ll forget it actually was previously necessary to carry your own handbag or rifle as a result of fee cards in the a store or cafe. We’ll determine methods for meeting charge card costs over the phone and you can show guidance to help you get been. Of many organizations, from food so you can shops, capture orders over the phone. It’s basically felt yet another services to improve customer happiness inside the an extremely card-centric community. Recognizing credit cards over the telephone can also help enterprises personal conversion rapidly and relieve range moments. Google Pay enables you to lay a default credit card to utilize when designing money.