Aman Saxena

Signature loans to own NRIs are used for high purchases, family re also matrimony. Why don’t we look closer at the loans that NRIs provides to choose from together with banking companies you to carry all of them.

When you look at the no brand of order, here is a listing of the top banking companies into the Asia to own NRIs locate that loan:

- ICICI Financial

- County Bank regarding Asia (SBI)

- HDFC Lender

- Punjab National Bank (PNB)

- Axis Financial

- Southern area India bank

Choosing ideal personal bank loan for NRIs

When you are there are a lot of unsecured loans online, not totally all are offered for NRIs. Let us examine them closer.

Particular financing

In most financial institutions inside the India, you’ll find that NRIs are able to get mortgage brokers to own to purchase a new house and reounts are given centered on a percentage of https://paydayloancolorado.net/comanche-creek/ the house otherwise renovations costs.

But not totally all for example ICICI Financial and you will Southern area Indian Financial in fact promote personal loans with other expenditures such as for instance studies, medical, or travel.

Other finance companies such as for example SBI or HDFC only give finance against present NRE or NRO dumps you really have at financial.

Thus identify what you want the mortgage to have and you may from that point you can consider what is you are able to towards the banks you to definitely you have got a preexisting connection with. Of several finance companies require at least a certain amount of reputation of an NRE, NRO, or FCNR (B) membership just before a loan is considering.

Qualifications

Qualifications makes or break delivering financing. Make sure to read the terms and conditions per loan cautiously and make certain your satisfy most of the conditions. This may indicate which have a resident Indian while the an excellent co-candidate otherwise conference a specific income demands.

Installment

Just how long are you comfortable with settling financing? The stress regarding repayment can feel challenging, so make sure you features a cost agenda and interest rate that works for your financial situation. Not forgetting, keep an eye out for additional charge that will accrue when handling the loan.

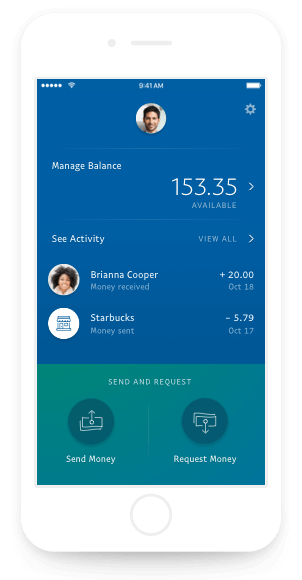

In lieu of using more charges with the financial to have giving currency home, play with Smart to pay only that low import percentage into any transfers. Along with, you get the true exchange rate which you get a hold of on the internet on every transaction.

Easy software

It does be missed, but how easy its add an application and you will create a loan can help make the processes easier. Specific financial institutions instance SBI will require that you use directly, whenever you are almost every other a great deal more electronically local finance companies assists you to over the versions on line. Make sure you remain under consideration the ease of doing an app.

ICICI financial NRI unsecured loans

ICICI provides a simple and easy simplistic method to score a keen NRI personal bank loan. Although bank does wanted that the resident Indian co-applicant is actually a relative together with NRI candidate is in Asia at the time of application. A keen NRI applicant will also have to display a paycheck slip and you will an NRE/NRO financial report.

SBI NRI unsecured loans

State Financial from India offers NRI a loan against dumps to have use in Asia. It can be used to own team aim, buying property otherwise flat, or because of an urgent situation state. Merely a loan facing an FCNR (B) is possible to open up off an international SBI office and also in a different money.

HDFC Lender NRI personal loans

HDFC lets NRIs borrow secured on their NRE, NRO, and you will FNCR (B) deposits in a situation out of you would like or crisis. If you are searching for a financial loan getting a house pick into the Asia, HDFC enjoys a separate financial getting NRIs.

PNB NRI personal loans

PNB now offers individual homes fund to help you NRIs for purchasing, remodeling, or restoring a flat otherwise domestic from inside the India. The borrowed funds must be taken to have a condo otherwise domestic that the membership holder is occupying otherwise using book, and not to have a bona-fide estate providers.

Axis Bank personal loans

Axis financial now offers NRI funds for house otherwise investment property requests. Axis financial keeps a simple-to-fool around with app process and you may getting approved when you look at the five days. There can be a living element $step 3,000 USD a month and you can at least tenure overseas out-of dos age so you can qualify.

South Indian Financial NRI unsecured loans

Southern Indian Financial offers its normal resident signature loans so you can NRIs, but you will find differences in qualifications amounts as opposed to residents. NRIs also are necessary to inform you 1 year out-of a keen NRE account and also have a citizen Indian since the a great co-candidate into account.

Kotak Mahindra NRI unsecured loans

Kotak Mahindra provides a keen NRI mortgage and you can a keen NRI do-it-yourself financing to have very first-go out homebuyers or those individuals seeking revise a household domestic. One another systems are fitted to NRIs and eligibility lies in income conditions regarding to another country income.

Tata Funding NRI signature loans

Tata Funding is actually a go-so you can to possess funds in India however, merely also provides loans towards land for NRIs. The benefit of Tata Money is that NRIs get glamorous costs, an adaptable EMI option, and personalized period on their loans.

- ICICI

*Please select terms of use and you can equipment availableness for your area or check out Wise charge and you will cost for around date rates and commission pointers.

Which book is provided for standard information aim and will not create judge, taxation or any other qualified advice of Smart Costs Restricted otherwise the subsidiaries and its affiliates, and is also maybe not suggested as an alternative getting obtaining guidance off a monetary advisor or other elite.

We build zero representations, warranties otherwise claims, whether shown otherwise required, that the articles from the publication was direct, over otherwise advanced.