Making use of home security are a selection for consumers who currently individual a timeless family. You might be exploring the idea of adding an ADU so you’re able to your residence otherwise getting into a compact little domestic and you will flipping your own huge a home with the accommodations. If that’s the case, you could potentially turn a few of your current household equity back once again to cash as a result of a home equity financing otherwise domestic collateral collection of credit (HELOC). This package fundamentally allows you to get the next mortgage to your your own brand spanking new household and employ the fresh lump sum payment of money so you can pay money for the small house. Comment the difference between family equity fund and you can HELOCs before you select, however, understand that which have both option, you can eliminate your property if you can’t continue with costs.

Occasionally, a tiny family into the rims could possibly get meet the requirements as a recreational automobile. According to Athletics Auto World Organization (RIVA), they have to be produced in compliance with government shelter criteria and you can getting deemed roadworthy to get a keen Rv permit. These types of lightweight homes are often also known as playground model RVs.If you’re looking purchasing an appropriately categorized and subscribed lightweight family, you could potentially funds it that have a keen Camper mortgage. These are constantly secured loans the spot where the car serves as their very own collateral, and in case you default, they can repossess they. The process is just like delivering a basic auto loan, however, lenders often demand more strict requirements given the larger loan numbers and could need a beneficial ten% so you’re able to 20% down payment.

Lightweight Family Builder/Manufacturer Finance

Firms that concentrate on strengthening or production tiny residential property may offer in-home capital otherwise manage lover lenders to greatly help consumers loans its orders. Such fund have a tendency to feature relatively positive conditions and you can much time repayment episodes, but they’re more challenging to track down versus more widespread possibilities for example individual and you can Camper financing.

If you are considering coping with a particular builder otherwise company so you’re able to create your lightweight household dreams possible, inquire about the commission options, because the not absolutely all designers bring capital applications.

Credit cards

In the end, while buying information to build your smaller domestic or deciding on affordable prefab small homes, you can test making the or every expenditures on the playing cards. But treat this choice to the maximum caution while the credit card desire can quickly send you toward a debt spiral if you are not able to easily pay off people notes you utilize.

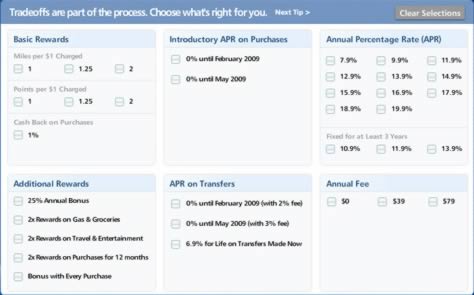

Should you choose this course of action, begin Hurtsboro loans by looking at an informed 0% Apr and you will reasonable-interest handmade cards offered. You can often find selling granting you an effective 0% basic Apr to own from around twelve to help you 21 months, so that you wouldn’t deal with charges or focus costs during that time so long as you improve minimal payments. Essentially, you should have a strategy in place to pay off the entire amount by the time the interest-free period expires.Rather, if you have the cash available to purchase a tiny domestic (otherwise its material) downright, thought starting credit cards that have an ample enjoy added bonus to earn cash right back otherwise circumstances for the huge get. When your month-to-month statement shuts, pay it back in full to enjoy the latest perks in the place of losing on the financial obligation.

Would it be Hard to get Acknowledged getting a tiny Household?

Regardless of the style of resource you realize, the recognition odds tend to boost with a good-to-excellent credit rating, constant money and you will lowest personal debt. Basically, it’s going to become more straightforward to select a loan provider when you’re seeking to a reduced amount borrowed (the new difference are if you’re looking to finance it that have a good traditional mortgage mainly because features minimum financing requirements).