*]:mt-0 [&_a]:text-bluish [&_a]:underline take off text-md md:text-lg best-normal min-h-[1.5em] font-regular [&>*]:last:mb-0″>Whenever you are seeking providing financing, like a home loan, auto loan, otherwise credit line, it is very important know what your credit score is. Whatsoever, this is your credit rating one lenders use to determine who in order to loan their funds so you’re able to and you may just what pricing supply all of them. Generally, the higher your credit score, the more likely you’re going to be so you can qualify for good mortgage.

*]:mt-0 [&_a]:text-blue [&_a]:underline cut off text-5xl md:text-7xl leading-injury font-black colored tracking-normal md:tracking-[-0.5px] mt-32″> Try an excellent 585 credit rating an effective otherwise bad?

*]:mt-0 [&_a]:text-bluish [&_a]:underline stop text message-md md:text-lg best-normal minute-h-[1.5em] font-typical [&>*]:last:mb-0″>If you’ve got a great 585 credit rating, you might be wondering in the event that’s a beneficial get or a beneficial bad get. According to Equifax Canada, among the nation’s several significant credit bureaus (organizations one to issue credit ratings), a great 585 credit score drops within the fair assortment.

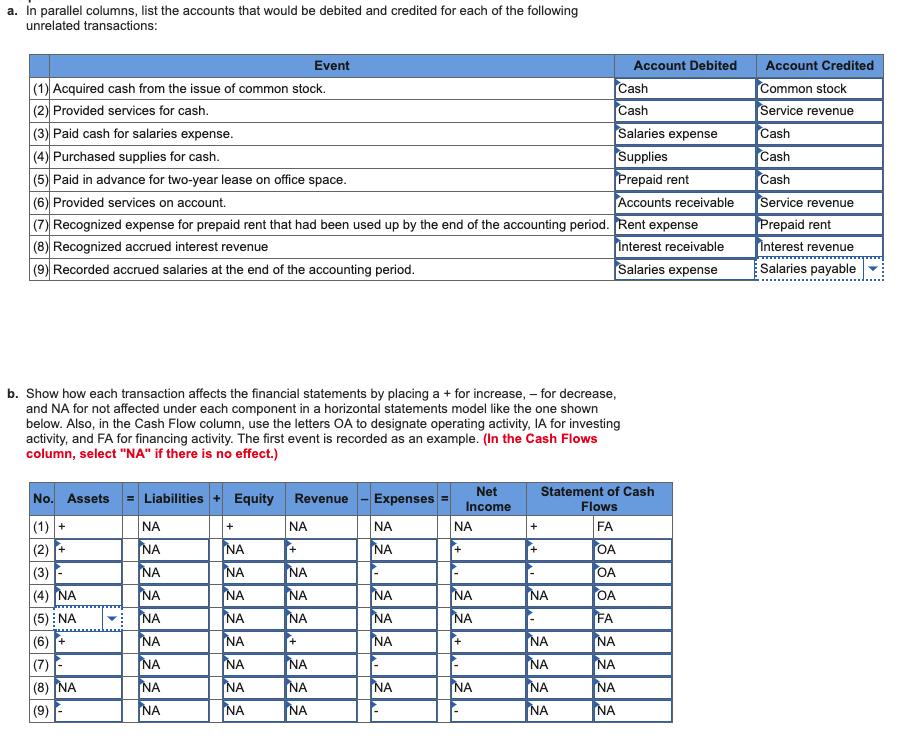

*]:mt-0 [&_a]:text-bluish [&_a]:underline block text-4xl md:text-6xl best-wound font-black colored mt-32″> Credit scores from inside the Canada

*]:mt-0 [&_a]:text-bluish [&_a]:underline stop text message-md md:text-lg best-typical min-h-[1.5em] font-normal [&>*]:last:mb-0″>Your credit rating was an excellent around three digit amount you to selections out-of three hundred to 900. As you can tell, there was an extensive difference as well as your get relies upon a good quantity of products. The latest TLDR is the fact that the highest your rating, the greater number of credit-worthy you will be determined is from the credit agencies and you may, thus, loan providers. A leading credit score unlocks numerous economic solutions, instance being qualified to possess minimal financing, best possibility of taking work given that specific employers, such those who work in this new financial features market, take a look at individuals fico scores through the criminal record checks and you will a top probability of being qualified to own a rental house.

*]:mt-0 [&_a]:text-bluish [&_a]:underline cut off text message-md md:text-lg top-regular minute-h-[step 1.5em] font-typical [&>*]:last:mb-0″>The typical credit score during the Canada, according to TransUnion, is 650. If you have a credit score away from 650, meaning your slip underneath an average credit history during the Canada. A get out of 585 is the low score somebody can be have and get a fair credit score rating. Luckily there are a great number of items you will do to improve their score. More on that inside some payday loan Dillon time.

*]:mt-0 [&_a]:text-bluish [&_a]:underline cut off text message-md md:text-lg best-regular minute-h-[step one.5em] font-typical [&>*]:last:mb-0″>Basic, regardless of if, let’s look closer from the average credit scores in a number of Canada’s biggest metropolises.

*]:mt-0 [&_a]:text-blue [&_a]:underline cut off text message-md md:text-lg best-regular minute-h-[step one.5em] font-normal [&>*]:last:mb-0″>Perhaps you have realized, an effective 585 credit rating was beneath the mediocre rating during the for each of them towns and cities. You will find several good reason why their rating may be reasonable as an alternative of good, like other of them score.

*]:mt-0 [&_a]:text-blue [&_a]:underline cut off text message-4xl md:text-6xl leading-injury font-black mt-32″> Products one adversely impact your credit rating

*]:mt-0 [&_a]:text-bluish [&_a]:underline cut off text message-md md:text-lg best-normal minute-h-[1.5em] font-normal [&>*]:last:mb-0″>You can find activities one to lower your credit history over the years. The financing bureaus assemble information regarding for each and every Canadian to assist them dictate fico scores, and several of everything an individual really does can cause an excellent score to reduce. This may involve:

*]:mt-0 [&_a]:text-blue [&_a]:underline take off text message-md md:text-lg leading-regular minute-h-[step 1.5em] font-typical [&>*]:last:mb-0″>This will be a giant that. Neglecting to generate financing percentage, should it be to have a charge card or other loans, have a significant bad influence on your credit score. A hefty thirty-five% of the credit score depends on the power to constantly fulfill the loan obligations. Hence, its vital to examine your credit history your past era from skipped repayments. Of the accepting these types of lapses and you may investing in punctuality throughout upcoming costs, you could gradually enhance your credit score.