As part of the application processes, the financial institution have a tendency to show your revenue and expenses by asking for a great confirmation off deposit from the financial. The lending company usually responds by post or fax. Second, the application form experiences the fresh new underwriting procedure. With respect to the difficulty of your own monetary data files, underwriting usually takes 21 forty five months to-do.

- Make sure to has actually adequate papers to show which you have come self-employed for no less than two years, and you will you kepted about 20% to possess an advance payment. Loan providers which offer lender report loans typically want to see you to definitely you’ve been able to save your self dos six months of money reserves.

- Keeps cash reserves easily accessible. Make sure that you’ve secured sufficient currency to fund several days from mortgage repayments and you will would one brief-identity need otherwise issues. Can you imagine, particularly, you kepted $ten,100 of your $20,100000 when you look at the discounts for your home loan repayments (dominant, interest, taxation and insurance rates). Might has actually 5 months’ worth of mortgage repayments saved.

- Avoid warning flags, including bounced monitors, nonsufficient loans fees and unexplained cash places. Dipping to the coupons a great deal otherwise usually being overdrawn cause security bells for loan providers and you can advances the possibility of the loan application becoming rejected.

- Always be upfront regarding the expenses activities and be ready to describe questions a loan provider otherwise underwriter could have regarding your cash.

The brand new criteria getting a bank statement mortgage as the a self-employed borrower may differ by financial. However, here are a few important standards you are going to need to satisfy to help you safer a lender declaration home loan:

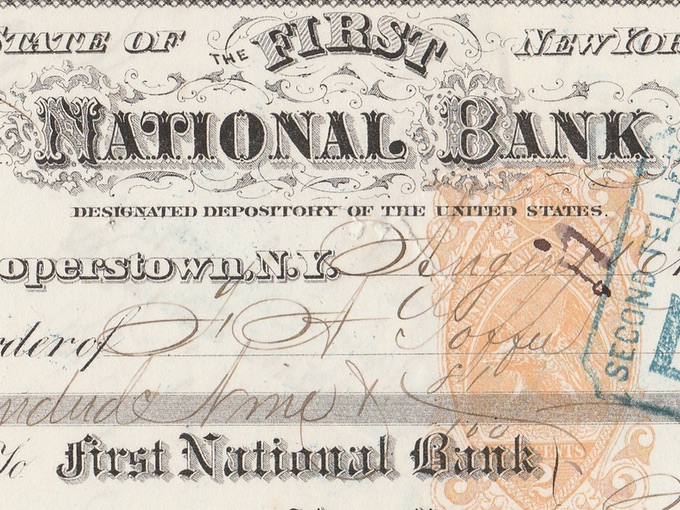

- a dozen 24 months of bank comments showing dumps and you can distributions for cash circulate facts (You can buy on line statement copies from the online bank-account.)

- Proof of at the very least 2 yrs away from notice-work or deal performs

- 660 credit history or more

- 20% down payment otherwise 10% off having mortgage insurance policies

- A beneficial DTI as high as fifty% (attempt to pay down normally of personal debt as you can be before you apply)

Even with good credit and you will a massive downpayment, it can be problematic having a borrower to safer an aggressive bank declaration financing interest. Indeed, sophisticated borrowing from the bank and you can reasonable-to-zero loans aren’t a guarantee that the application form techniques is smooth sailing.

Just after a loan provider assesses your own bank craft and you can decides the debt-to-income (DTI) proportion (which is the portion of their disgusting monthly money used to the the debt), they will decide how much your meet the requirements so you can acquire

A lender may consult so much more files just before giving a financial declaration financing, such a letter from the accountant otherwise bookkeeper explaining your company expenses and verifying https://elitecashadvance.com/installment-loans-va/ your income since a separate contractor otherwise freelancer.

Expert suggestion: Improve your probability of providing a bank report mortgage (and one with a decent financial declaration loan speed) by continuing to keep your finances under control.

Just be sure to pay back any obligations in place of making use of the cash you’ve kepted for the downpayment or dipping in the cash supplies. Keep an eye on your bank account balances to prevent overdrafts. Do not sign up for any higher-money loans 6 8 days before applying into home mortgage. Whenever your own financial otherwise underwriter wants a conclusion otherwise significantly more documents in advance of they’ll give a bank statement loan, respond As quickly as possible and be truthful and you may initial on your interaction.

How to See a lender Report Loan?

Not all home loan company even offers financial declaration loans. Required some extra strive to look for a lender who will qualify you predicated on bank comments in place of tax data.