Everyone given that around the globe people take knowledge financing in our house nation to follow degree during the United states given that studying Pros inside the U . s . Will cost you a fortune and not everyone can pay for they, we grab education loans. I want to share with you my tale as well as how We repaid of my education loan and explain as to why this is the greatest.

My Education loan information

We took $twenty-five,000 out of student loan when you look at the India to possess my All of us degree out of among federal banking companies. As ever, everbody knows, it wanted most of the property files otherwise any property so you’re able to backup the loan. Ultimately, i wound up bringing financing additionally the interest we got was fourteen% Rate of interest per year. Its named Apr (Apr for the United states).

Interest rates for the All of us compared to India otherwise the country

While i authored when you look at the article Where you should put your currency either inside the United states otherwise India?, the attention cost in United states are very lower. It is into the either side, sometimes getting borrowing from the bank money otherwise your money seated in checking account. Within the Us, you can purchase a personal bank loan for about nine% Apr or even reduced. Sometimes, discover balance transfers on your own cards where you can mark cash for less Apr. The main area is, its lesser so you’re able to borrow cash from a great All of us Lender than from your own home nation particularly India. Within this context, for many who only glance at the difference in All of us Unsecured loan versus Indian student loan interest rates, there is a substantial variation regarding 14 nine = 5% Annual percentage rate.

Just how did I pay loan? Most practical method to expend student loan in your home nation?

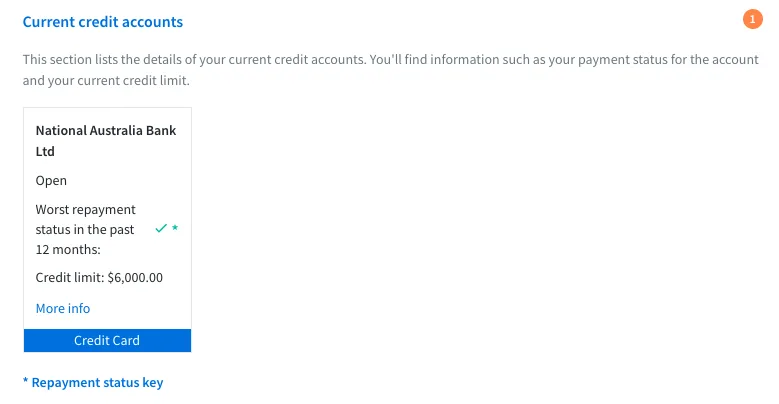

Over the course of my personal student lifestyle within the Us, You will find build good credit Records. When i finished and you may got employment, We returned to a single regarding my personal financial institutions that i had be the cause of very long and you can expected him or her if i you will definitely score an unsecured loan. We have looked right up particular banking institutions and promote personal loans without the cover for as much as $twenty five,000. However, you may already know, they work on your own credit score assessment and find out your credit report. And, they requested add my personal spend stubs of past a couple of days. Once i registered what you, it provided me with an unsecured loan off $25,100 without the safety support such as for example vehicle or things. I got all of the currency and you may sent back so you’re able to India. I’d the us loan having 8.9%, my personal Indian education loan is 14%. I did a strong preserving of five.1% per year. In installment long term loans no credit check Cleveland MO order to cost you new numbers,

- its a preserving of $1,275 per annum getting $twenty five,100 financing. If you have not knew, you may have saved step 1/20 th of your own amount borrowed into rate of interest per year.

- By firmly taking 5 years to repay the borrowed funds, then you can cut more $5,one hundred thousand only on the interest.

Anyways, the explanation to take financing for the All of us is merely simple, low interest rates. There are many choices also, you may want to just take an effective 0% balance transfer towards the playing cards as well if you’re unable to get an effective loan. The single thing is that you may have 4% deal percentage and you can stuff, but if you want to pay they later or you enjoys plenty, I think its really worth providing it.

Ways to get Education loan in Us due to the fact as the Internationally Student ? No Credit rating ?

One of the encouraging Y-Combinator financed fin-tech startups founded from the around the world youngsters, just who went through an identical travels, provides an option for worldwide college students/ working advantages to locate individual/student loan. You can purchase financing having refinancing your own education loan, close our their handmade cards, buy their moving, partner education, an such like. You should buy mortgage from $step 1,100000 USD to $thirty-five,100000 USD depending on the qualification, even without credit rating. you make credit score, should you get financing acknowledged. You will find hitched together with them, you can Apply for Personal loan / Student loan on Stilt

Might you think of all other creative treatment for pay off the student loan home based country once Graduation and getting work in the All of us ?