twenty two September First time Home buyers

Buying your earliest domestic are going to be exciting and daunting during the exact same day, occasionally way more if you find yourself figuring out the Virtual assistant family financing processes. There are a lot of inquiries you actually features. Luckily for us, we’re right here to provide you with brand new answers you need.

The purpose is always to make your first-time home buying sense easier much less overwhelming. Understanding the software process can be greatly reduce this new unfamiliar and you may anxieties that include doing things for the first time. Making it convenient on you, visit the page of the best Virtual assistant mortgage brokers and they’ll become more than simply happy to simplicity you from process of securing your own Virtual assistant mortgage capital and purchasing the first family.

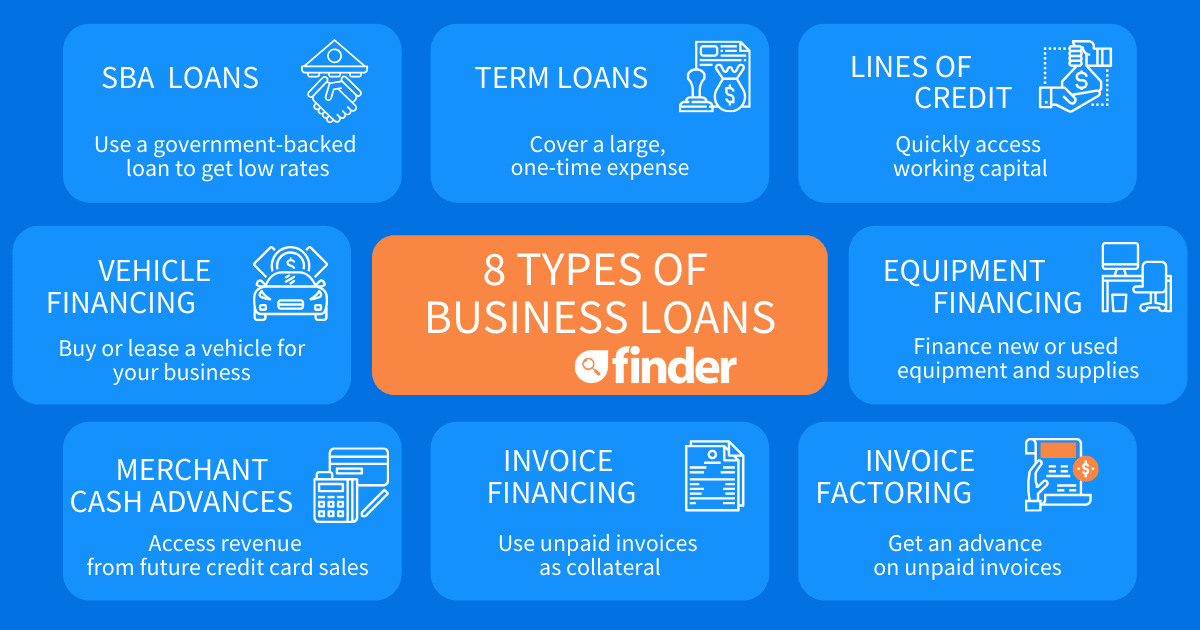

Though you happen to be at beginning of the property to invest in techniques, you have got probably already discover you will find several selection nowadays to own financial support your first financial. For each program features its own positives. For most recent armed forces professionals, experts, and you can army group, new Virtual assistant Mortgage commonly provides the appropriate experts they demand.

Which are the benefits associated with an effective Va home loan?

- Since these loans was financially supported (guaranteed) of the Agency away from Pros Facts which means loan providers suppose reduced risk, there are no credit checks to possess degree and also whenever factoring interest rates, a borrower’s credit history was a reduced amount of an issue than just which have antique home loans.

- For a number of first-time homebuyers, preserving thousands of dollars to the a deposit is challenging. This is actually the same getting solution players and you may veterans. Which have a traditional mortgage, a property client will have to put down a minimum of 5 per cent into the the price of its household in accordance with Financial Homes Administration (FHA) money they might need to lay out 3.5 percent.

- This means, if for example the house is $250,100, a classic lender would need $12,five-hundred off and you may an FHA bank would need $8,700. Slamming one to number as a result of $0 lets services players and veterans an opportunity to pick an excellent home they or even may not have had.

Examine 2022’s Finest Va Lenders. Federally Covered. 0% Down. Energetic Responsibility, Veterinarian & Nearest and dearest. Faucet to compare Rates. No money Down.

- By way of competitive rates of interest available through the Va Mortgage system plus the lack of a personal mortgage insurance policies (PMI) requisite, Virtual assistant Loan borrowers can conserve thousands of dollars through the the life span of the mortgage.

When you made a decision to start looking for very first household, the initial concern you truly been curious about is actually, What exactly are sensible payments for me? There are certain factors which go for the getting your self a home loan payment you could would.

We within Pros Unknown are creating a cost calculator to your Virtual assistant Mortgage program. Provide a go to see how much cash from a cost you would getting secure during the.

- Current costs to the personal debt

- Annual earnings

- Simply how much is positioned off getting a down-payment, if any

- Additional issues, such as citizen connection fees and insurance policies

Once the processes will be state-of-the-art, make sure you get a hold of an agent who knows brand new means of qualifying and funding a beneficial Virtual assistant home loan. It is in addition crucial to see an agent who’ll identify the requirements of current military users and you can pros.

This is why, we on Pros Anonymous have amassed a directory of home representatives exactly who specialize in permitting armed forces family members choose the best household to them.

In the first place, you will need to setup a scheduled appointment which have a loan manager. The mortgage administrator can look more than your financial situation and you will contour away just how much out of a loan youre qualified for. After that is determined, might done and you may fill out the application.

Below are a few profiles you will find developed for household people seeking to qualify for the fresh Virtual assistant financial system: