Regardless if you are happy to build another family now, otherwise looking to and obtain home earliest, we possess the right loan for you.

Property Loan

The house loan equipment allows borrowers to finance the brand new residential property towards the that they will eventually create a home, be it a primary household or one minute household.**

Family Framework Financing

That have one-close structure mortgage out-of Service Borrowing from the bank Commitment, you will Kingston installment loans have the funds you should buy belongings and create your residence every having you to mortgage. The house design financing even offers an attraction-just percentage to possess some go out from inside the design of the property.

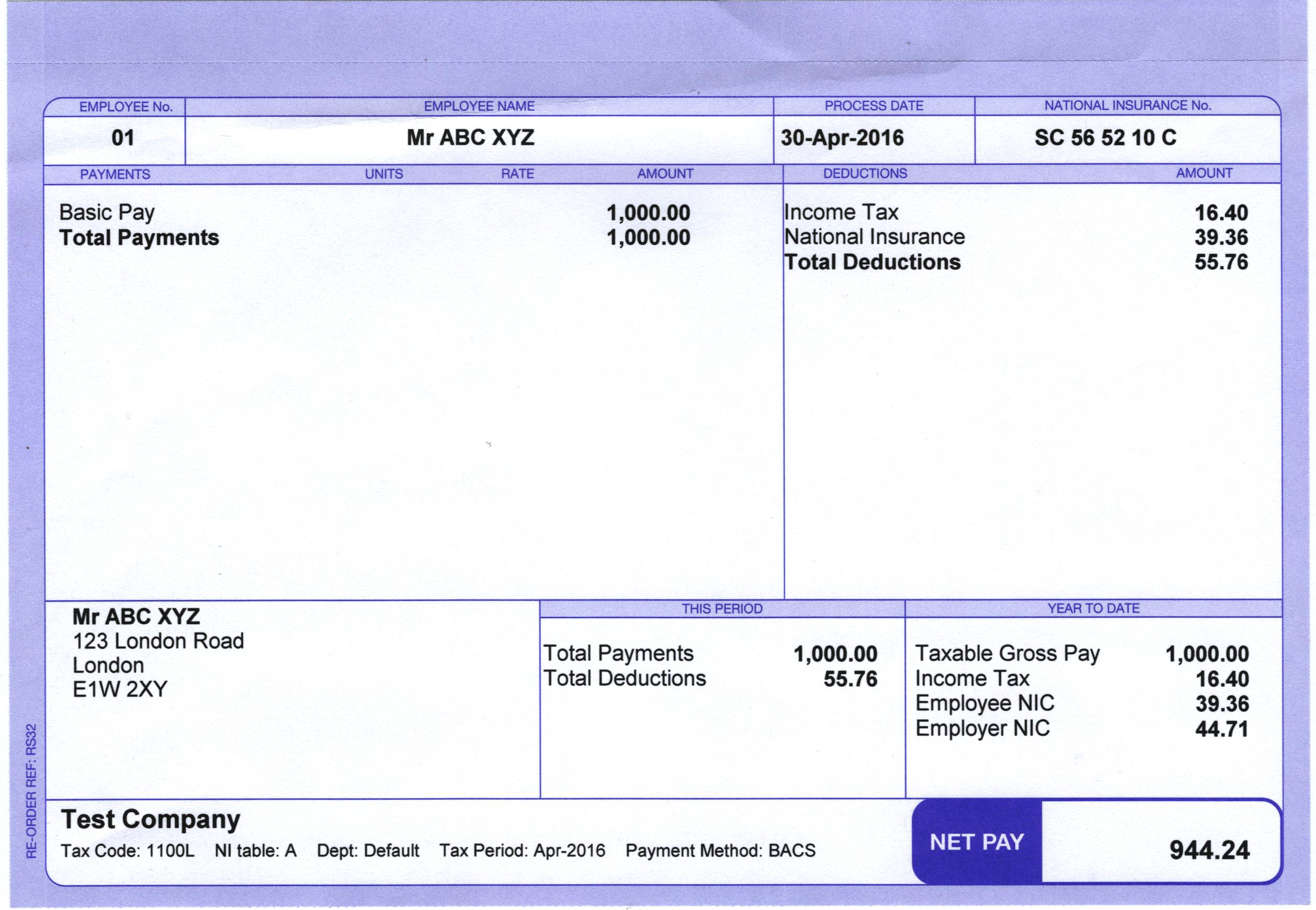

Mortgage/House Equity Pricing***

*Costs shown are Annual percentage rate (APR). HELOC promotion rate out-of dos.99% Annual percentage rate is restricted for the first 12 months. Pursuing the advertising and marketing months, the speed will vary according to the Wall surface Path Log Primary Prime speed authored into the history business day of the few days, six.25% . Minimum line of credit is actually $ten,100. Possessions insurance is requisite. Into the 10-seasons draw period property Collateral Personal line of credit having a good equilibrium off $10,100000 and Apr away from 2.99% to the very first twelve battery charging schedules can lead to twelve attention only repayments away from $. Pursuing the marketing several months a balance away from $ten,100000 and you may varying Apr out-of 6.25% can lead to 108 notice just payments off $, followed by 180 money off $ and another (1) latest percentage off $ from inside the payment period. Commission analogy does not include fees and you can insurance coverage; actual commission obligations would be better. During the draw months minimum percentage required is attention just. Closing costs will connect with household collateral credit lines covered by properties that are indexed for sale. Functions currently in the business was susceptible to credit history, title, recording, payment, and appraisal charge (as much as $900). Existing Solution Credit Partnership HELOC’s are not entitled to which promotion. An early on termination commission regarding $eight hundred enforce when the paid back and signed within 3 years of unwrapped. The price tag might possibly be waived if refinanced having Provider Federal Borrowing Connection, increasing the totally new line of credit amount of the at the very least $ten,one hundred thousand, or if perhaps the borrower paid back closing costs toward home guarantee line of credit. At the mercy of credit worthiness and you will hold requirements. Have to be a current representative or qualified to receive membership. Venture runs out-of 9/1/2022- and is susceptible to transform or perhaps abandoned without notice.

**Services Borrowing from the bank Relationship will money around 80% away from property mortgage. Assets have to be a good buildable package given that affirmed of the a soil ensure that you roadway frontage

***The new exhibited rates having conventional fund guess an amount borrowed off $250,100000 getting one-family members, owner-occupied purchase deal with a deposit out of forty% and you can a credit score of 740 or maybe more. Va rates imagine an amount borrowed from $250,000 no down payment. Conventional jumbo money suppose an amount borrowed regarding $647,201 and you can an excellent forty% down payment. Va jumbo assumes on a loan amount off $647,201, without advance payment. Percentage advice can be obtained because of the pressing the fresh new assess costs button significantly more than and don’t include taxes or insurance fees. Payment obligations was highest. To help you be eligible for the fresh new $five-hundred borrowing from the bank into the settlement costs, the newest candidate have to be a member of Services Borrowing Commitment or eligible for registration, need certainly to open otherwise possess a bank checking account having Service Borrowing from the bank Union that have internet payroll head deposit, and ought to decide automated costs away from you to savings account on the label of financing. The credit would-be applied within closing and should not feel directed or replaced getting a profit similar. Subject to alter or even be deserted anytime.