Interest rates and you may Annual percentage rate are two frequently conflated conditions one send to equivalent principles but have subtle distinctions with regards to computation. Whenever contrasting the expense of a loan or line of credit, it is very important comprehend the difference between new stated interest rate and the annual percentage rate (APR), that has any extra will cost you otherwise fees.

Key Takeaways

- The pace ‘s the cost of credit principal, and this speed are said in the course of loan closing.

- The fresh Annual percentage rate is close to constantly more than the speed, because boasts other costs associated with borrowing the bucks.

- New government Details in Credit Work makes it necessary that all of the personal loan arrangement listing this new Annual percentage rate along with the moderate interest.

- Loan providers have to proceed with the exact same legislation to guarantee the precision of the fresh Annual percentage rate.

- Consumers with the best borrowing from the bank in most finest credit requirements may safe 0% Annual percentage rate selling.

Interest

New reported speed, or affordable rate of interest, is utilized when calculating the attention debts on your own mortgage. Particularly, if you were offered a mortgage loan getting $200,one hundred thousand which have a good 6% rate of interest, your own yearly attract expenses would total $a dozen,000, or a monthly payment out-of $1,100.

Rates are determined by the new government money price put because of the Federal Set-aside, called the Given. Within this perspective, the new federal funds price is the rate at which banking companies lend reserve balance some other banks at once. Including, while in the a financial credit crunch, the latest Fed often generally reduce the fresh government finance rate to help you encourage users to spend currency.

Throughout periods from strong financial development, the exact opposite will happen: the latest Government Set-aside often typically improve interest rates over time so you’re able to remind so much more offers and balance out income.

Prior to now few years, the fresh Provided altered interest rates apparently scarcely, from around one to 4 times a year. Although not, back into this new credit crunch out-of 2008, costs was in fact gradually reduced seven moments to fully adjust to industry conditions. Without determinant regarding home loan or other interest levels, it will possess a big determine, hence shows huge business standards.

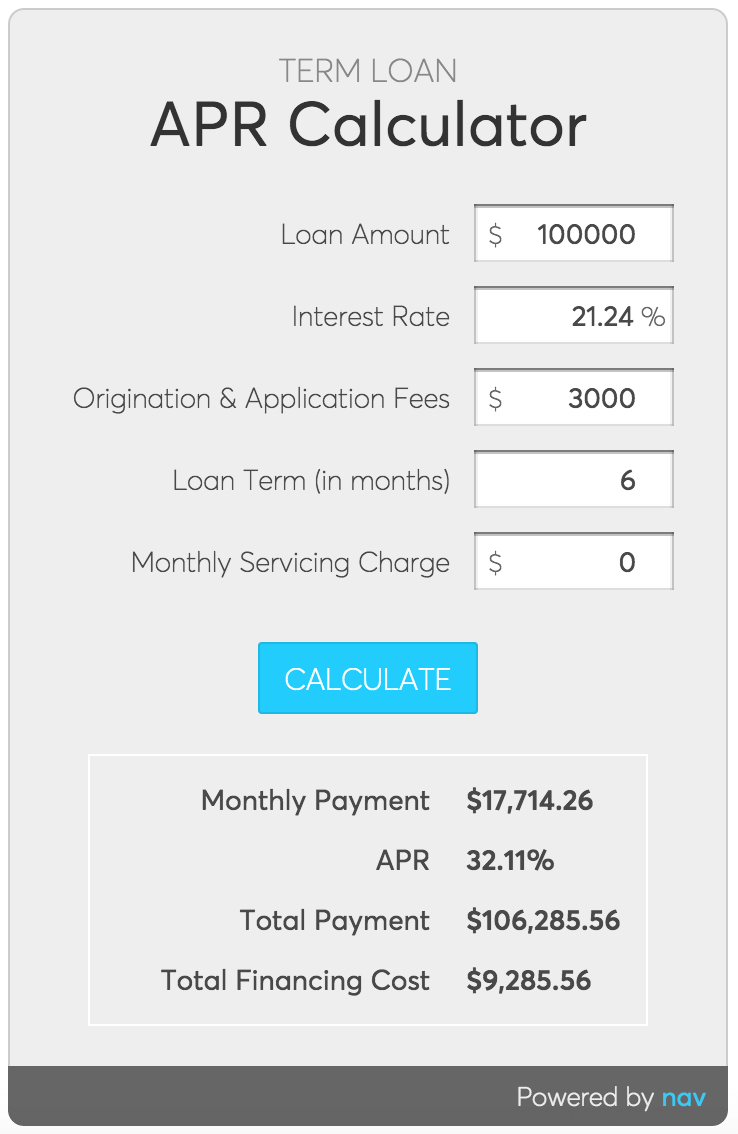

Brand new Annual percentage rate, not, is the more efficient rates to take on when comparing fund. The newest Annual percentage rate comes with not only the attention bills with the mortgage plus most of the charges and other will set you back involved in procuring brand new financing. These charges may include broker charge, closing costs, rebates, and you will dismiss items. These are tend to expressed because a percentage. New Annual percentage rate should always be more than or comparable to the fresh moderate interest rate, except in the example of a professional offer in which a loan provider can offer a rebate towards the a fraction of their attention expense.

Back again to this new analogy significantly more than, take into account the fact that your residence purchase and additionally demands closing costs, mortgage insurance, and you will financing origination costs in the quantity of $5,000. So you’re able to dictate your own mortgage loan’s ount to help make an effective the latest loan amount from $205,100000. The newest 6% interest rate will then be regularly calculate a new annual commission from $a dozen,300. So you’re able to determine the fresh Apr, merely separate the brand new annual percentage regarding $a dozen,three hundred because of the totally new loan amount off $2 hundred,one hundred thousand to get six.15%.

When you compare a couple of money, the lender providing the lower nominal rates will render good value, given that majority of the loan number was funded during the a all the way down rates.

The situation very perplexing so you can borrowers happens when a couple loan providers are offering the same affordable price and you can monthly payments but other APRs. Inside the a case similar to this, the financial institution with the lower Apr is actually requiring fewer upfront charges and providing a far greater offer.

The application of the fresh new Apr comes with several caveats. Because lender maintenance costs within the Annual percentage rate was give aside along the whole life of mortgage, possibly so long as 30 years, refinancing or offering your property will make the home loan higher priced than in the first place ideal by Apr. Other limitation is the APR’s diminished functionality from inside the capturing the fresh genuine can cost you off a changeable-price home loan because it’s impractical to expect the long term assistance of interest pricing.

Rate of interest against. Apr

The interest rate and you may Apr to the a loan echo the fresh costs to help you borrow funds off a loan provider to possess a designated period of time. Although not, per differ come into how they is calculated, what they show, and just how far manage a debtor enjoys over for every.

On top of that, you’ll find ways to believe whenever entering into plans. No matter if a purchaser can be lured to dive from the low rate, so it ple, envision good homebuyer choosing whether or not to shed their interest price or eradicate their Annual percentage rate.

By the adopting the low interest rate, the debtor will get keep the lowest monthly installments. Yet not, consider the right position where a lender can pick anywhere between one financing charging 5% and another loan battery charging cuatro% having one or two discount points (

Is much more good if you’re not thinking about staying in your home extended-name (due to break-even section for costs)

Is generally more favorable should you decide on the residing in your house expanded-identity (due to Annual percentage rate presumptions along side entire identity)

Why is Annual percentage rate Greater than the rate?

Annual percentage rate is comprised of the rate stated on the that loan and fees, origination costs, discount items, and you may agency costs reduced towards bank. This type of initial prices are added to the primary equilibrium of one’s mortgage. Hence, Annual Brighton loans percentage rate can often be greater than the fresh mentioned interest rate as the count are lent try theoretically highest following the fees was indeed considered whenever figuring Apr.

Is Annual percentage rate Be Equal to otherwise Below the rate?

Apr can not be lower than brand new mentioned rate of interest, even though Annual percentage rate additionally the mentioned rate of interest would be equivalent. Apr always has even more fees it is possible to pay for the mortgage and you will try a far more comprehensive logo of all will set you back you’ll be able to end up being credit. If there are no a lot more can cost you or charge so you’re able to secure the borrowing, the Apr and you will interest are equivalent.

Do 0% Annual percentage rate Mean Zero Desire?

Yes, 0% Annual percentage rate form you pay no attention into transaction. Be careful one particular 0% Annual percentage rate plans is generally temporary (we.elizabeth. 0% Annual percentage rate having half a year, upcoming a higher Annual percentage rate afterward). Concurrently, 0% Annual percentage rate purchases can still sustain initial or one-time charge.

What’s an effective Annual percentage rate?

Annual percentage rate ‘s the prices to borrow cash, very a diminished Annual percentage rate is advisable getting a borrower compared to the a high Annual percentage rate. Apr may also differ in accordance with the purpose of the mortgage, duration of the loan, and you can macroeconomic conditions that affect the financing side of the loan. Typically, the best Apr is actually 0% in which no attention is paid, for even a short-term having a primary introductory several months.

The bottom line

Once the rate of interest decides the price of credit currency, new Annual percentage rate is a very perfect picture of total credit prices because it requires into account other costs associated with procuring a great loan, such as for example home financing. When choosing hence loan provider in order to borrow funds from, it is crucial to pay attention to the Apr, meaning the genuine cost of resource.