- Initial acceptance. When the a loan provider approves your for an excellent HELOC, you’ll receive this new words. If you move forward online payday loans Tennessee, the lender often verbally make sure your own employment info is the newest same and your insurance try newest.

- Intimate. Brand new close is booked, will within two weeks of the 1st app, pending any waits in the process.

- Financing readily available. Money are generally offered contained in this weeks or days of your own finalized lending intimate.

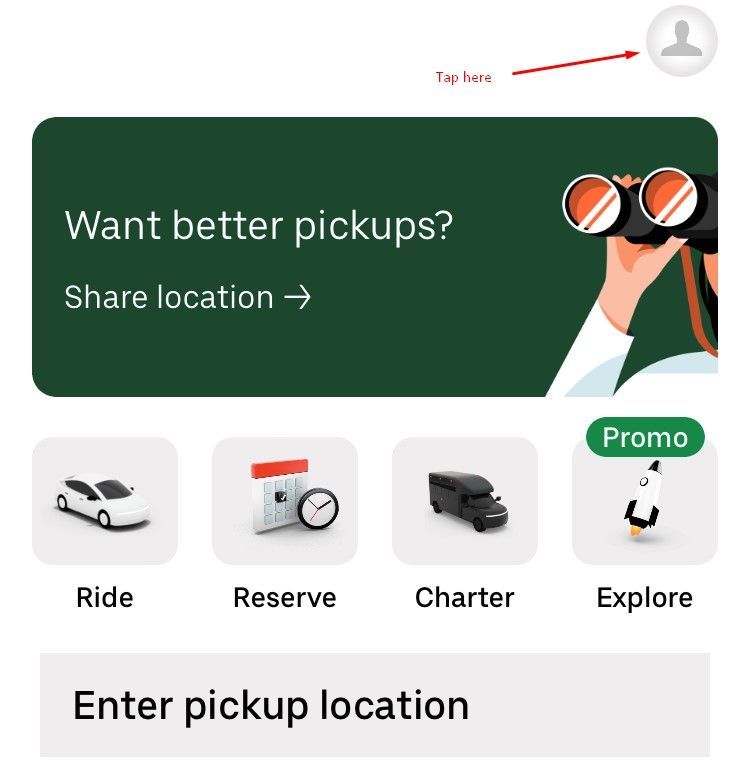

Beneficial HELOC Application Information

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/cmg/JM47FVM2UJEI7FERH625YDRWIU.png)

- Cannot get almost every other lines of credit prior to wanting a great HELOC. Those people apps is also lower your credit score and increase the purchase price of one’s HELOC, Reiss claims. Speak to your accountant or monetary mentor to verify that appeal to your HELOC might possibly be tax deductible. It probably was, but it is best that you establish which.

- Understand the difference in mark several months and you can cost several months. Learn in the event your rates increases as well as how this may apply at their fee.

- Know your credit rating and exactly how which is going to influence prices. Decide if you will want to take the appropriate steps to evolve your credit rating before you apply.

- Cautiously feedback your own Facts-in-Credit revelation.

- Look out for one minimum mark otherwise limitation balance criteria.

- Stop a great HELOC one need an excellent balloon fee otherwise an excellent lump-sum installment of your own balance.

Advantages & Cons regarding HELOCs

When you are HELOCs is going to be a solution when you have sufficient equity of your home, if you possibly could not manage to make payments, you may be placing your home on the line. Knowing the pros and cons out of a good HELOC makes it possible to determine if this is actually the right kind of financing for your demands.

Benefits associated with an excellent HELOC

Compared to other sorts of fund, an excellent HELOC is let you use a higher count, based on your house collateral.

You should use an excellent HELOC having debt consolidation, refinancing otherwise any domestic repair programs. If you decide to upgrade your home using a great HELOC, you can subtract the interest from your own fees, thanks to the Tax Cuts and you can Efforts Operate regarding 2017.

Yet not, you have to make the improvements for the home you will be borrowing from the bank facing while increasing the worth of your residence. Such, strengthening a share or a deck increases the value of your home, but if you repaint the new home or exchange a broken installation, you cannot deduct the attention from your taxes.

HELOCs are beneficial where they are a whole lot more versatile than other mortgage possibilities. You can obtain what you need and you may spend notice with the only one in lieu of searching a more impressive lump sum. For people who just need $5,000 but get approved having $fifty,000, you don’t need when deciding to take the complete acknowledged matter.

While doing so, HELOC loan providers bring more repayment choice. Some loan providers render a fixed-speed choice, and many let you possess a phrase all the way to 31 many years.

Cons out of an effective HELOC

Though HELOCs offer versatile investment choices, it is critical to envision if these are generally ideal for their requires. A house equity credit line which have a variable interest means the rate is really affected by interest rate change because of the Government Set-aside. A sharp increase in the speed can result in a tall month-to-month rise in your instalments – with no caution.

As a result, someone commonly undervalue what the money would-be when they enter the newest fees several months. You should do a bit of scenario-thought with a high rates of interest when choosing exactly what your payment usually become. Specific HELOCs need good balloon percentage, definition you will have to spend the money for complete harmony in one single commission. Balloon money is going to be hard to generate unless you features spare cash on give, and you will incapacity to pay can cause foreclosure on the house.