- What your need to know about buying a foreclosed home

- How can home foreclosures really works?

- Sorts of foreclosures

- Money a foreclosed domestic

- Cons of buying a foreclosed home

- Very long process with more documentation

- Family standing issues

- Battle

- Pros of buying a foreclosed home

- Contract prices

- Money solutions

- Build smart a residential property assets in partnership with Fall in

Discover foreclosed land within the virtually every market in the united kingdom, and buying a foreclosed domestic might easier after the mid-2000s mortgage crisis. Pursuing the moratorium for the foreclosure, in response into the COVID-19 pandemic, ended into the , traders expected a boost in property foreclosure. But not, the audience is nonetheless watching a restricted likewise have and you may tall competition. Top added bonus during the to find good foreclosed house is will set you back, but erratic timelines, solutions, and you may sturdy race can get discourage you from to invest in an excellent foreclosed domestic.

There are lots of kind of foreclosures: pre-foreclosure, small sales, sheriff’s product sales, bank-had, and bodies-owned. All particular property foreclosure possess unique properties, therefore the pick techniques may vary. Imagine choosing a representative who is accustomed brand new property foreclosure techniques. They are able to offer specific opinion considering their knowledge.

How can home foreclosures work?

When an owner cannot create repayments on their financial, the bank requires fingers of the home. The lending company always delivers a notification off default after ninety days off missed money. Will, new homeowner gets the chance to policy for a new fee bundle towards bank before home is ended up selling. While purchasing good online payday loans in WI foreclosed household, youre getting the family regarding the financial, perhaps not new home’s amazing manager.

Type of foreclosure

Pre-foreclosure: Since manager is in standard on their mortgage, he’s notified by financial. In the event the resident can sell the house or property inside pre-foreclosures several months, they could avoid the foreclosures procedure and some of one’s affects on their credit rating.

Small conversion: If a resident is actually lasting financial hardship, they are able to to offer their home inside the a preliminary marketing. The lending company must commit to accept reduced to your assets than the new resident already owes on the home loan. Small conversion process is extended as bank should react and you can approve the offer.

Sheriff’s business: Sheriff’s conversion process try deals kept immediately following home owners default on their money. These types of auctions is actually facilitated of the local the authorities, and therefore title sheriff’s deals. Within these deals, your house comes into large bidder.

Bank-had features: If a home does not sell during the auction, it will become a bona-fide property holder (REO) assets. The loan financial, lender, otherwise mortgage buyer possess the home, and they form of qualities are now and again also called bank-owned homes.

Government-owned qualities: Similar to REO properties, such house was initially bought playing with an enthusiastic FHA or Virtual assistant financing, both authorities-straight back loans. Whenever such attributes are foreclosed and do not sell within auction, it be bodies-holder properties. Next, he’s ended up selling from the brokers who work on the part of brand new company hence provided the loan.

Capital a good foreclosed home

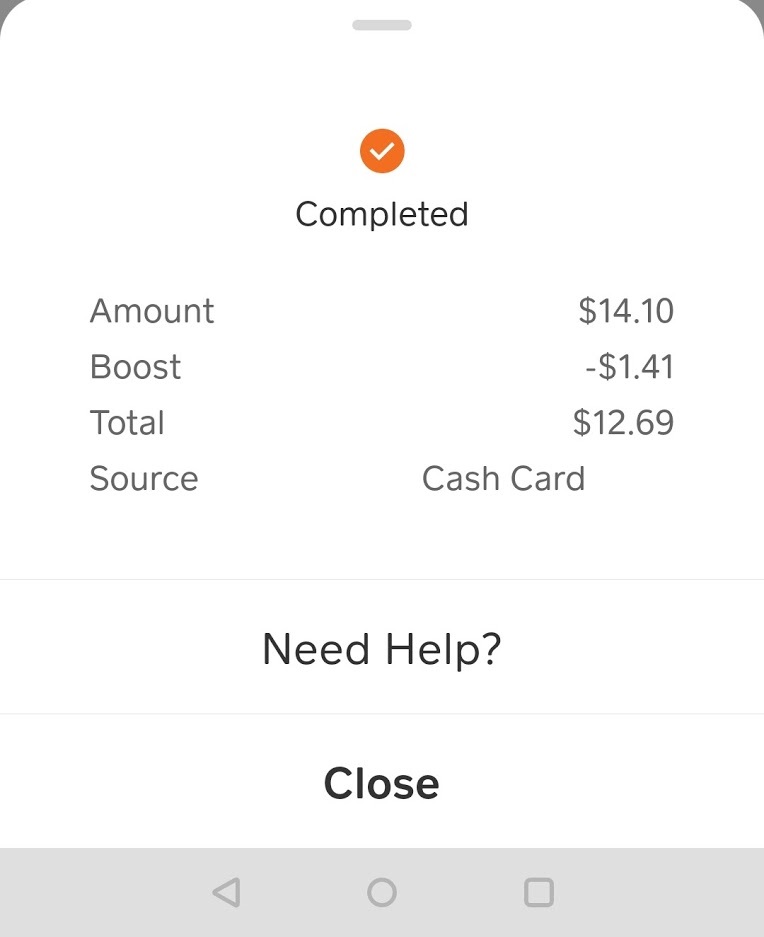

If you find yourself most of the cash offers gives your own biggest advantage whenever buying an effective foreclosed house, some capital choices are readily available for capital features. Keep in mind that individual lenders is generally less likely to financing the acquisition off a good foreclosed household. So you can facilitate the procedure, thought choosing a lender and receiving pre-recognized for a mortgage.

When you’re interested in purchasing a foreclosures, we recommend examining the government-backed money options available to people whom be considered. A great 203(k) mortgage is a kind of investment available with the newest Federal Homes Government (FHA). There are a few different kinds of 203(k) money. You’ll fundamentally feel energized a mortgage premium to help you offset the bank’s exposure. Additionally, you will discover interest levels for those sort of funds go for about 0.25% greater than old-fashioned loans.