Upgrading you reside typically a wise resource. Home improvements can also be a lot more enhance the selling value, aside from, raise your enjoyment and spirits of your home. But home improvement plans, big or small, was barely cheaper. And you can except if you have been squirreling aside some extra dollars throughout the decades, you’ll be able to most likely get into the market for a loan. But what kind of mortgage would you like for those brands of plans?

First off, Know the Issues!

Do-it-yourself money allows you to pay for renovations and fixes. Together with best benefit? You do not also have to use your property because collateral. Do-it-yourself loans are generally unsecured personal loans, you could and right back them up utilizing your residence’s equity.

If you are searching to own financial support, make an effort to understand how do it yourself financing works therefore you could potentially purchase the monetary services that really works right for you and your condition. This can need just a bit of legwork on the avoid evaluating interest levels, costs, and you may terms. Constantly compare multiple even offers before making a decision on financial that’s right for you. You want that loan that meets your money as well as the measurements of assembling your shed.

Understand your options!

You have got far more solutions for you than just do you consider. Instance, you don’t need to promise on your own or your own earning power to redesign your house.

1. Family Equity Credit line (HELOC)

One of the biggest benefits out of home ownership is the fact youre usually strengthening guarantee over time. Domestic equity helps you availableness cash to have home improvements within all the way down rates of interest than signature loans. Likewise, HELOC loans are a great capital solution because they accommodate immediate access to financing. A HELOC is good revolving credit line, meaning you can access the money as soon as you have to.

Yet not, as you are with your family as the security, you may be susceptible to shedding your home if you default into the payments. Another thing: HELOCs provides changeable rates of interest, and your minimum fee utilizes the brand new market’s requirements.

dos. Household Collateral Financing

There clearly was absolutely nothing difference in property guarantee mortgage an additional mortgage. Its a fixed-price mortgage paid in a lump sum payment that you’ll pay back into instalments more a predetermined lifetime. That advantageous asset of house equity funds is you don’t possess to bother with transform towards the payment due to alterations in the speed.

step three. Financial Refinance

Refinancing enables you to change your property security for the cash. Generally, you take aside a special financing to displace your brand-new home loan, and you also can pocket the real difference, if you have people. This 1 can supply you with the other cash you will want to deal with some household solutions.

Mortgage refinancing does have a little extra costs, as well as assessment and you will origination charge, taxation, and closure-related fees. But, if you possibly could decrease your interest, it is well worth it in the long run.

cuatro. Signature loans

What if you dont want to secure the loan update endeavor together with your family. In this case, delivering an unsecured loan is a wonderful choice. These unsecured loans are given because of the finance companies, loan places Rye borrowing unions, and many on the internet loan providers.

The borrowed funds amount and interest are very different based on their borrowing score and you can current financials. And you will defaulting with this kind of financing will cause that take a knock when it comes to those areas. Normally, such money are best for small update programs such window substitutes or starting an alternative cabinet program.

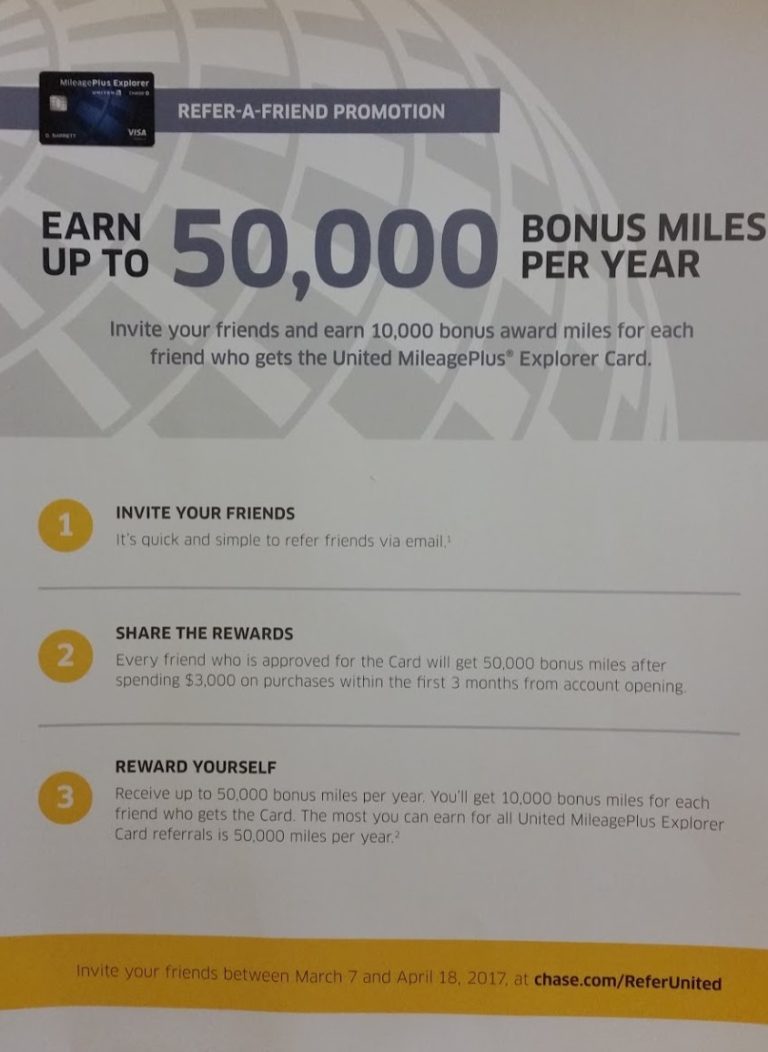

5. Playing cards

If you want to build small fixes otherwise smaller improvements particularly starting yet another hot-water heater, a charge card will help cover the costs. Concurrently, certain credit cards was attract-free into the basic months definition you get to pay the latest recovery prices over that point without paying most into the interest.

Handle Home improvements Smartly

Shop around and constantly build a barrier into your funds. Regardless of solution you choose, your month-to-month expenditures is actually destined to increase.