Approaches for Home loan Rate Evaluation

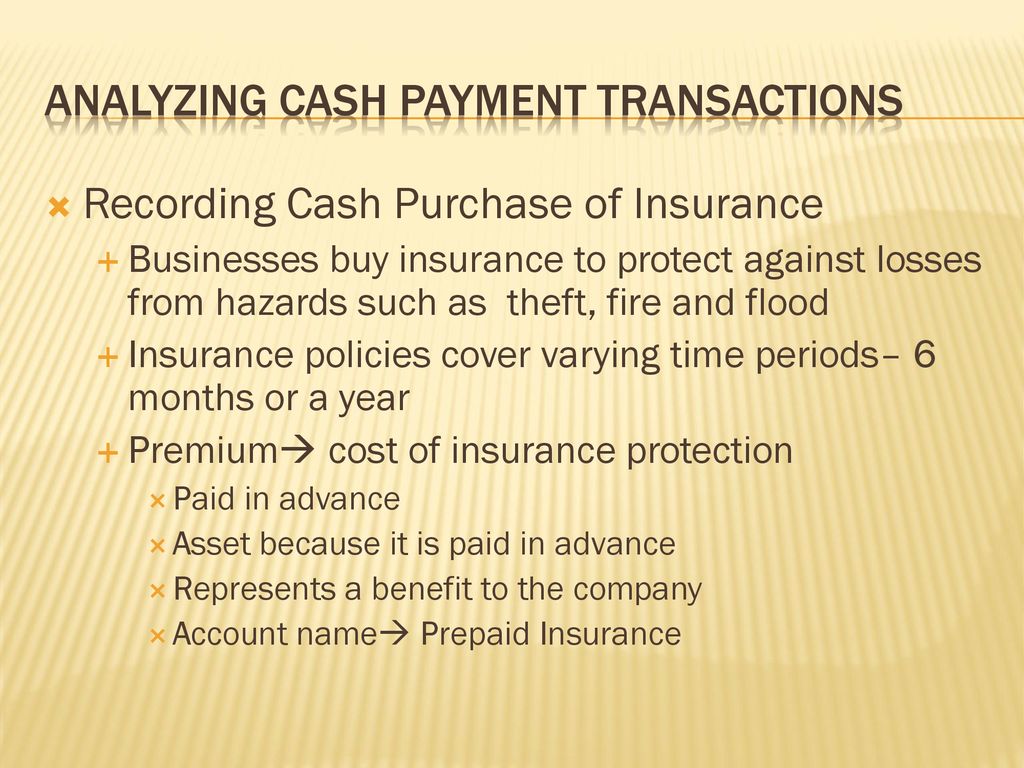

Whenever carrying out their rate assessment, prioritize knowing the apr (APR) because it reflects the true cost of borrowing from the bank.

Check out the importance of brand new loan’s name duration on your analysis. Shorter terms usually have high monthly obligations but trigger quicker interest paid back across the lifetime of the borrowed funds.

Do not ignore the significance of your credit rating. A powerful borrowing character can be grant access to preferential prices, efficiently lowering your long-name monetary weight.

Eventually, method rates review on the enough time-term visualize at heart. The aim is to secure a home loan one aligns having both the money you owe and homeownership expectations.

Leverage Their Borrowing to have Better Conditions

- Opinion Your credit score: Examine to have discrepancies that’ll negatively feeling their score.

- Maintain Commission Punctuality: Appearing precision inside the past repayments bolsters bank believe.

- Treat A great Debt: Straight down debt-to-income percentages are positive inside financial feedback.

- Restrict The newest Borrowing from the bank Concerns: For each and every difficult inquiry can some diminish your credit score.

- Generate an extended Credit score: A continual period of borrowing use leads to a positive research.

http://www.clickcashadvance.com/personal-loans-mn/

Mortgage loans for the Greenville NC

Whenever looking to live in the desirable abodes away from Greenville NC, a critical action is the selection of an appropriate home loan supplier.

Within this pursuit, many upcoming home owners consider mortgage loans borrowing from the bank union possibilities, known for its competitive prices and you may individualized service, providing a residential area-concentrated financial option.

Borrowing from the bank unions inside Greenville expand a warm invitation, guaranteeing attentiveness and designed solutions on your quest for the ideal mortgage loan.

Local Borrowing Relationship Selection

Entering your way off owning a home in the Greenville NC or Tarboro NC, discerning customers often look for the attractive terminology provided with mortgage loans credit relationship options, concentrating on a customized and you will society-mainly based means.

It offer a philosophy out-of matchmaking banking, making sure members found attention to outline and you may comprehensive advice through the financial procedure.

Having deep root in the neighborhood, borrowing unions in Greenville NC and you will Tarboro NC offer more only financial services-they promote connections you to most readily useful serve the initial needs out of local customers as they browse the reasons of the house-to invest in process.

For this reason, getting prospective property owners, the choice of a mortgages borrowing from the bank partnership can get show besides economic prudence also a good investment about societal and you will monetary fabric of their community.

Navigating Greenville’s Housing industry

Prospective people inside the Greenville, North carolina face a diverse industry. Regarding progressive metropolitan condos so you can vast suburban locations, the fresh new city’s a property choices can be fit individuals life-style and costs. not, entering this market demands an enthusiastic comprehension of regional styles, fiscal conditions, and you will funding options to safe a house that fits individual need and standards.

The fulcrum for success rests into the securing beneficial financial support terminology. For most, mortgage loans borrowing union partnerships promote a path not just to homeownership as well as to help you a lot of time-label monetary balance.

The marketplace beckons which have prospect of very first-day customers and you will knowledgeable dealers the same. Navigating this type of ventures which have a close look for detail-especially in economic agreements-can change the newest daunting task of getting property toward a worthwhile capital.

In search of a mortgage in the Tarboro NC

The fresh new quest for homeownership within the Tarboro NC needs consideration regarding mortgage selection, certainly an elaborate area of the domestic-to buy picture. People who live-in which lovely North carolina city or try seeking getting section of the neighborhood has a definite virtue-the means to access mortgages credit union solutions that can offer customized monetary plans designed to their novel circumstances. These types of credit unions often give aggressive costs and an even more intimate customer service feel, an important line getting possible customers navigating this new ins and outs of your mortgage landscaping. They stay since pillars locally, troubled in order to assists new transition on homeownership that have each other stability and you can a deep knowledge of neighborhood sector forces creating Tarboro and you may the surrounding portion.